Our latest investment fund is now open!

North Miami Beach, Florida

Fund closes in:

Fund Progress

Updated every 6 hours*

Benefits of Investing with Coachwood Capital.

- Higher returns relative to Canadian markets.

- Bayview Palms is located in a B+ location in a global A class market.

- The Miami market is among the fastest growing markets in the US.

- Coachwood does all of the heavy lifting to make this a truly passive investment.

- Bayview Palms has the potential to offer superior returns passively compared to an actively managed portfolio in Canadian markets.

- Higher returns relative to Canadian markets.

- Bayview Palms is located in a B+ location in a global A class market.

- The Miami market is among the fastest growing markets in the US.

- Coachwood does all of the heavy lifting to make this a truly passive investment.

- Bayview Palms has the potential to offer superior returns passively compared to an actively managed portfolio in Canadian markets.

- The Miami market job and population migration is among the strongest in the US.

- Limited partners assume only limited risk according to the percentage of their ownership.

- Partnering with a team of experienced professionals.

- Leveraging our underwriting process to select properties.

- Reducing expense ratios and increasing returns by pooling funds through economies of scale.

Are you ready to reserve your spot in this investment fund? – Let’s get you started.

Have more questions? – We’d be happy to address any questions or concerns.

Open to Accredited & Non-Accredited Investors.

ROI: Target Return on Investment over a 5-year term.

Target Cash on Cash Return over a 5-year term.

Watch our replay of the Bayview Palms investment opportunity presentation.

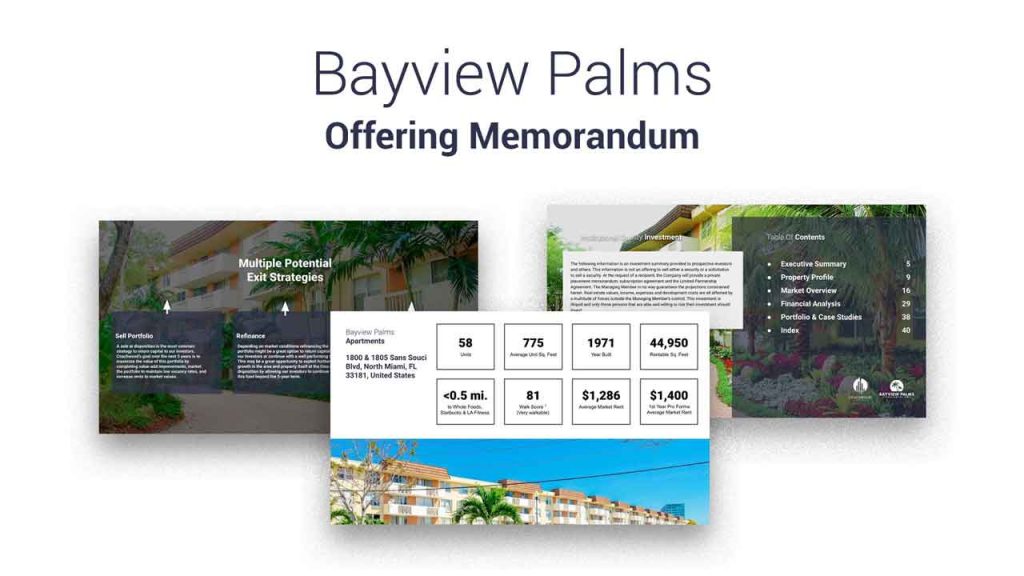

View the full Offering Memorandum here.

Are you ready to reserve your spot in this investment fund? – Let’s get you started.

Have more questions? – We’d be happy to address any questions or concerns.

Take a look at our most frequently asked questions about this investment opportunity.

Distributions are paid directly into your account monthly on the 15th according to the cashflow of the previous month.

Watch this video for a detailed explanation <<<<

Distribution is not necessarily treated as a dividend but will retain its character from an income tax perspective (i.e. rental income, capital gain, interest, etc.). Depending on performance of the LP, initial distributions may also be treated as a “return of capital.”

To simplify with a reasonable assumption, the LP will likely have “rental income” or “rental loss” in each year until it sells the property…therefore the investors will get a tax slip with their proportionate share of this “rental income” or “rental loss”. At disposition, there will likely be a “capital gain”…the investors will then get a tax slip with their proportionate share of this “capital gain”.

Because of depreciation and other costs there may actually be a “loss” or “rental loss” for tax purposes in the US LP…if this is the case and you still make cash distributions to investors (which you will) then there technically is no “income” to distribute…so essentially you are giving them back some of their own money return of capital from an accounting perspective.

The US LP will be depreciating the properties pursuant to US income tax rules, therefore investors will obtain the benefit of these deductions.

We can accept either Canadian or US funds. If you decide to send Canadian funds we can complete the currency exchange for you at a very competative rate.

You can be an accredited investor, familiy and/or friend, or business associate of someone on the Coachwood team. If you any questions regarding this requirement or if you are not sure if you quality please reach out to us for more information.

Yes, we can send distributions to an American bank account.

We do get better currency exchange rates because of the exceptionally high volume of funds we exchange on a daily basis and are able to process the exchange for you, but it is not necessary.

When investing in this opportunity you become a Limited Partner in the company that owns the property and will lock your investment in for the full term.

Unfortunately, we cannot predict a black swan event. But, what Coachwood does is choose properties that are capable of still performing if in fact such an event occurs. Furthermore, our CEO Dan Crosby started his journey during the 2008 real estate market crash, which was to date one of the most dramatic crashes the market has seen. You can be rest assured we have the experience and knowledge to deal which such events.

Absolutely. In fact this is a great way to increase your overall return because of the 1031 exchange option which Coachwood Capital intends on leveraging for it’s investors and partners.

Yes, we can accept both Canadian and US investors.

Unfortunately, it will not allow you to have a personal US address.

The risks are outlined in the OM and similar to any other real estate investment. However, because of our extensive experience and knowledge we feel confident in our ability to reduce these potential risks as much as possible by choosing the right property, using conservative underwriting, and managing the properties properly.

Are you ready to reserve your spot in this investment fund? – Let’s get you started.

Have more questions? – We’d be happy to address any questions or concerns.